J.ophthalmol.(Ukraine).2022;1:58-62.

|

http://doi.org/10.31288/oftalmolzh202215862 Received: 25 July 2021; Published on-line: 15 March 2022 Changes in the quantitative characteristics of the Ukrainian market of tear replacement products for dry eye disease over 2016-2019 V. M. Sakovych 1, Yu. O. Tomashevska 2, O. V. Makarenko 1, O. V. Kryvoviaz 2, M. S. Garnyk 2 1 Dnipro State Medical University; Dnipro (Ukraine) 2 Pirogov National Memorial Medical University, Vinnytsia; Vinnytsa (Ukraine) TO CITE THIS ARTICLE: Sakovych V. M., Tomashevska Yu. O., Makarenko O. V., Kryvoviaz O. V., Garnyk M. S. Changes in the quantitative characteristics of the Ukrainian market of tear replacement products for dry eye disease over 2016-2019. J.ophthalmol.(Ukraine). 2022;1:58-62. http://doi.org/10.31288/oftalmolzh202215862 Background: Management of dry eye syndrome (DES) is a current medical, pharmaceutical and social issue both globally and in Ukraine. Purpose: To assess changes in quantitative characteristics of the Ukrainian market of tear replacement products (TRPs) for dry eye disease over 2016-2019. Material and Methods: Data from the national pharmacy-related registers and from PharmXplorer, a marketing research database from Proxima Research LLC, were used for research. Sales were assessed in terms of both packages and Ukrainian hryvnias (₴). Retrospective, structural and graphical methods were used for research. Results: Of the TRPs available on the market, only 10.7% were Ukrainian products. Almost half (46.43%) of the TRPs were those whose price range was from ₴101 to ₴200. The smallest share of the market (14.28%) was attributed to the most expensive TRPs. In addition, almost half of the products of the lowest price range (₴100 and under) were domestic products. Conclusion: the number of domestic TRPs in the Ukrainian pharmaceutical market is limited. A stable increase in TRP retail sales both in packages and hryvnias indicates a stable and positive increase in demand for therapeutic products for dry eye patients. A Ukrainian lowest-price niche medical device containing both dexpanthenol and taurin was an absolute leader of 2016-2019 TRP retail sales. Keywords: tear replacement products, dry eye syndrome, retail sales, price niches

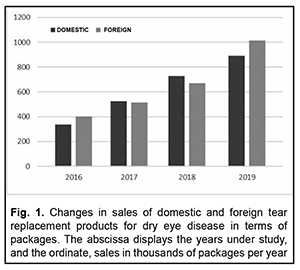

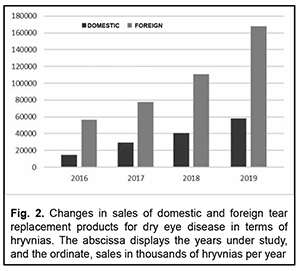

Introduction Management of dry eye syndrome (DES, also known as dry eye disease) is a current medical, pharmaceutical and social issue both globally and in Ukraine, with 10-30% of working-age adults having DES [1, 2]. The condition is a tear film disorder [3, 4] with a variety of subjective symptoms [5, 6] including eye dryness, itching, scratchiness, pain, stinging or burning, redness, tearing, foreign body sensation, blurry vision, light sensitivity, increased sensitivity to environmental factors, etc. [7, 8]. The disease does not cause death directly, but significantly impairs quality of life [3, 9] and imposes a significant cost burden on patients, society and healthcare systems. These costs may include those due to visits to an ophthalmologist [10], diagnostic assessment procedures [11], and temporary loss of capacity to work and pharmacological therapies [12, 13]. Over-the-counter tear replacement products (TRPs) are the first line of therapy for DES [14–16]. Their mechanism of action is associated with the impact on certain components of an impaired tear film renewal in dry eye syndrome [17, 18]. Since there is paucity of available data on the use of and expenses for over-the-counter TRPs, the purpose of the study was to assess changes in quantitative characteristics of the Ukrainian market of tear replacement products for dry eye treatment solutions over 2016-2019. This will allow assessing and making predictions regarding the financial burden on patients and health-care system utilization for dry eye disease pharmacotherapy. Material and Methods We conducted the analyses of changes in retail sales characteristics over the period of 2016-2019 based on the results of our previously performed marketing analysis of the tear replacement products available in the Ukrainian pharmaceutical market [19]. Data from the national pharmacy-related registers (the State Register of Medicines of Ukraine [20] and the State Register of Medical Equipment and Medical Devices of Ukraine [21]) and from PharmXplorer [22], a marketing research database from Proxima Research LLC, were used for research. Sales were assessed in terms of both packages and Ukrainian hryvnias (₴). Retrospective, structural and graphical methods were used for research. Market segmentation categories included the manufacturer’s country of origin, price niches and TRP components. An increase in tear replacement sales in terms of both packages and Ukrainian hryvnias (₴) was assessed using the following formula: ΔM=(Sy+1 - Sy)*100%/Sy, where ΔM is a percentage increase in the market size, Sy+1 is TRP sales in the year following the comparison, and Sy is TRP sales in the year of comparison. Results Figures 1 and 2 show changes in the amount of sales of TRPs for treating DES in terms of packages and hryvnias, respectively, over 2016-2019. The results obtained indicate that domestic and foreign manufacturers had approximately equal shares of the Ukrainian market of TRPs (as assessed in thousands of packages per year), although of the TRPs available on the market, only 10.7% were Ukrainian products. However, the percentage difference between annual UAH amounts of retail sales of TRPs from foreign manufacturers and those from Ukrainian manufacturers varied from 267.47% in 2017 to 383.52% in 2016 (and was 271.49% and 289.24% in 2018 and 2019, respectively).

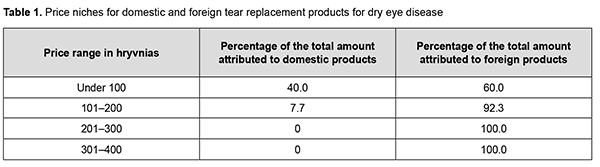

We identified the four price ranges for the TRPs available on the Ukrainian market (Table 1). Almost half (46.43%) of the TRPs were those whose price range was from ₴101 to ₴200. The smallest share of the market (14.28%) was attributed to the most expensive TRPs, with a price range above ₴300. In addition, almost half of the products of the lowest price range (₴100 and under) were domestic products (Table 1).

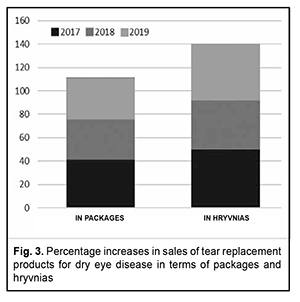

Discussion There was almost a constant annual increase in the amount of sales of TRPs for treating DES in terms of packages and hryvnias, respectively, over the period of 2016-2019 (Fig. 3).

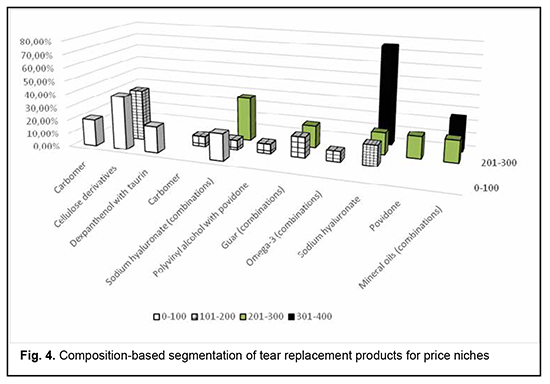

The next phase of the study was to perform composition-based segmentation of tear replacement products for price niches (Fig. 4).

The portion of TRPs containing mineral oils in combination with other active pharmaceutical components (APC) was the largest (25%) in the ₴301-₴400 niche. All TRPs containing povidone were in the ₴201-₴300 niche. Sodium hyaluronate-based TRPs were present in three price niches, with the highest percentage in the most expensive one. The combination products containing omega-3 fatty acids, polyvinyl alcohol and povidone were present in the ₴101-₴200 niche. Equal shares of combination hydroxypropyl guar-containing TRPs were present in the ₴101-₴200 niche and the ₴201-₴300 niche. The price of most multicomponent sodium hyaluronate-based TRPs was between ₴201 and ₴300, the price of more than a quarter of these products, under ₴100, whereas that of the rest, between ₴101 and ₴200. All TRPs containing both dexpanthenol and taurin were in the cheapest niche (under ₴100). The price of the single component products containing methylcellulose derivatives as well as of those containing carbomer, was under ₴200. The number of TRPs as well as the number of combinations of APCs was the largest in the second niche (i.e, the ₴101-₴200 niche), and the lowest in the fourth niche (i.e, the ₴301-₴400 niche). The segmentation of retail sales of all TRPs available in the Ukrainian pharmaceutical market found that the TRP containing both dexpanthenol and taurin had the highest annual hryvnia sales and the highest annual package sales. This product is in the lowest price niche, manufactured in Ukraine, and is registered as a medical device. Because any TRP is registered in Ukraine either as a medicinal agent or as a medical device, the percentages attributed to medicinal agents and those attributed to medical devices were calculated for each price niche. The price niches varied in the ratio of the percentages attributed to medicinal agents and to medical devices. The ratio was greater than 1 for the highest price niche (i.e, the ₴301-₴400 niche), and substantially smaller than 1 for other niches. A limitation of the presented analysis of tear substitution products for treating DES is that the presence of preservatives and the quality of buffer solution contained in a product was not taken in account. However, this is important, because usually a TRP is used for a rather long time and should be safe for patients. Nevertheless, some aspects of this issue were addressed in our previous study [23]. Conclusion The current study found that the number of domestic TRPs in the Ukrainian pharmaceutical market is limited. Since the above TRPs are in the low price segment and leaders in terms of amount of sales in packages, it is reasonable and promising to stimulate pharmaceutical science to develop highly-efficient and affordable TRPs of various compositions. In addition, a stable and positive increase in TRP retail sales both in packages and hryvnias indicates a stable increase in demand for therapeutic products for dry eye patients. A Ukrainian lowest-price niche medical device containing both dexpanthenol and taurin was an absolute leader of 2016-2019 TRP retail sales in terms of both packages and hryvnias. The results obtained will be used to determine seasonal changes in sales of tear replacement products for treating dry eye disease. Moreover, the pandemic caused by SARS-CoV-2 resulted in an increased use of gadgets by individuals of various age groups, potentially leading to an increased occurrence of the symptoms associated with visual system overload (particularly, dry eye syndrome), and we plan to compare characteristics of 2016-2019 TRP retail sales with those after the beginning of the pandemic caused by SARS-CoV-2. References 1.[Dry eye syndrome. Evidence-based clinical guidance]. [Internet]; 2019. Ukrainian. Available from: https://www.dec.gov.ua/wp-content/uploads/2019/11/2019_10_02_kn_syndrom_.... 2.Stapleton F, Alves M, Bunya VY, Jalbert I, Lekhanont K, Malet F, et al. TFOS DEWS II epidemiology report. Ocul Surf. 2017;15:334-65.. 3.Craig JP, Nelson JD, Azar DT, Belmonte C, Bron AJ, Chauhan SK, et al. TFOS DEWS II Report Executive Summary. Ocul Surf. 2017 Oct;15(4):802-12. 4.Bron AJ, de Paiva CS, Chauhan SK, Bonini S, Gabison EE, Jain S, et al. TFOS DEWS II pathophysiology report. Ocul Surf. 2017;15:438-510. 5.Craig JP, Nichols KK, Akpek EK, Caffery B, DuaHS, Joo CK, et al. TFOS DEWS II definition and classification report. Ocul Surf. 2017;15:276-83. 6.The management of dry eye. Drug Ther Bull. 2016;54(1):9-12. 7.Jones L, Downie LE, Korb D, Benitez-del-Castillo JM, Dana R, Deng SX, et al. TFOS DEWS II management and therapy report. Ocul Surf. 2017;15:575-628. 8.Willcox MDP, Argüeso P, Georgiev G, Holopainen J, Laurie G, Millar T, et al. TFOS DEWS II tear film report. Ocul Surf. 2017;15:366-403. 9.Friedman NJ. Impact of dry eye disease and treatment on quality of life. Current Opinion in Ophthalmology. 2010;21(4):310-6. 10.Alves M, Fonseca EC, Alves MF, Malki LT, Arruda GV, Reinach PS, et al. Dry eye disease treatment: a systematic review of published trials and a critical appraisal of therapeutic strategies. Ocul Surf. 2013;11(3):181-92. 11.Wolffsohn JS, Arita R, Chalmers R, Djalilian A, Dogru M, Dumbleton K, et al. TFOS DEWS II diagnostic methodology report. Ocul Surf. 2017;15:539-74. 12.Dogru M, Tsubota K. Pharmacotherapy of dry eye. Expert Opin Pharmacother. 2011 Feb;12(3):325-34. 13.Pucker AD, Ng SM, Nichols JJ. Over the counter (OTC) artificial tear drops for dry eye syndrome. Cochrane Database Systematic Rev. 2016 Feb 23;2:CD009729. 14.U.S. Food, Drug Administration. Ophthalmic drug products for over‐the‐counter human use. www.accessdata.fda.gov/scripts/cdrh/cfdocs/cfcfr/CFRSearch.cfm?CFRPart=3... (accessed 26 August 2015). 15.Rodríguez-Pomar C, Pintor J, Colligris B, Carracedo G. Therapeutic inhibitors for the treatment of dry eye syndrome. Expert Opin Pharmacother. 2017 Dec;18(17):1855-1865. doi: 10.1080/14656566.2017.1403584. Epub 2017 Nov 14. PMID: 29115899. 16.Lee SY, Tong L. Lipid-containing lubricants for dry eye: a systematic review. Optom Vis Sci. 2012;89(11):1654-1661. 17.Çakır B, Doğan E, Çelik E, Babashli T, Uçak T, Alagöz G. Effects of artificial tear treatment on corneal epithelial thickness and corneal topography findings in dry eye patients. J Fr Ophtalmol. 2018 May;41(5):407-411. doi: 10.1016/j.jfo.2017.06.032. PMID: 29776765. 18.Lemp MA, Bron AJ, Baudouin C, et al. Tear osmolarity in the diagnosis and management of dry eyedisease. Am J Ophthalmol. 2011;151(5):792-8. 19.Kryvoviaz OV, Tomashevska YuO. [Remedies for substitution therapy of the dry eye syndrome: analysis of the pharmaceutical market of Ukraine]. Pharmaceutical Review. 2019; 4, 37-44. Ukrainian. 20.[State Register of Medicines of Ukraine (2019)]. Available from: http://www.drlz.com.ua/ibp/ddsite.nsf/all/shlist?opendocument. Ukrainian. 21.[State Register of Medical Equipment and Medical Devices (2019)]. Available from: https://mozdocs.kiev.ua/medvyrob.php. Ukrainian. 22.Pharmxplorer. Proxima Research. 2012. Available from: http://www.pharmxplorer.com.ua. [Last accessed on 2020 Oct 01]. 23.Tomashevska YuO, Kryvoviaz OV. Ensuring the sterility of substitution therapy medications for dry-eye syndrome treatment after opening the original packaging. Scientific journal of Polonia university. 2021;44(2021) nr 1:278-283.

Conflict of Interest Statement: The author states that there is no conflict of interest that could affect her opinion on the subject or materials of this manuscript. Sources of Support: none.

|